Separation from Federal Service: A Guide for Federal Employees

- Instar

- Feb 26, 2025

- 8 min read

Whether separation from Federal service is something you’ve been planning for quite some time or something that might be forced upon you, the information below is designed to help you be as prepared as possible when you leave Federal employment.

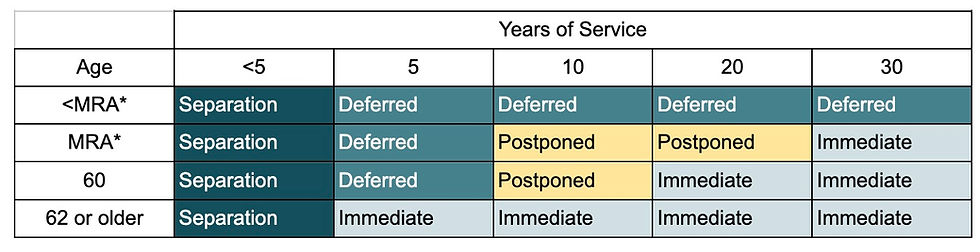

Types of Separation/ Retirement

The chart below is an overview of the type of separation/ retirement you might be eligible for based on your age and years of service. To use the chart, find your age. Then find your current years of service. Where the row and column intersect is the type of separation/ retirement you will most likely fall into.

NOTE: This chart does not apply to CSRS, Foreign Service, Law Enforcement Officers, Air Traffic Controllers, or any other special FERS categories. It does not apply to Non-Appropriate Fund (NAF) personnel.

*Minimum Retirement Age (MRA) depends on your year of birth. If you were born in 1970 or later your MRA is age 57. If you were born before 1970 your MRA is between age 55 and age 57 (see chart below)

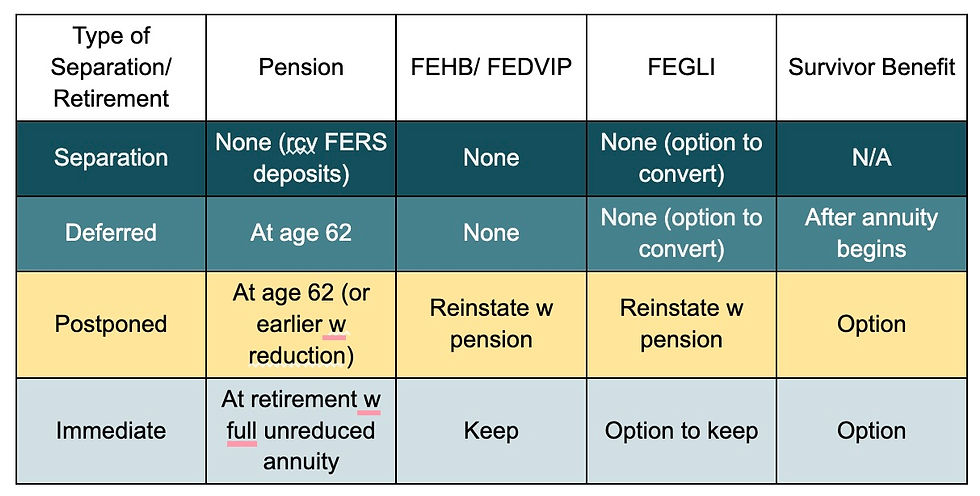

Benefits for each type of Separation/ Retirement

Your type of separation/ retirement drives how your pension (if any) works and what benefits you are entitled to. Find your type of separation/retirement in the chart below for a general overview:

Click one of the links below for more details:

Separation (less than 5 years of service at any age)

Are you eligible for a pension if you leave with less than 5 years of service?

You don’t qualify for a pension, but you can receive your FERS deposits. The options to receive your FERS deposits are:

Receive a lump sum distribution. The deposits are after-tax except for any interest that has accrued. You will owe tax on the interest portion.

Roll the assets to an IRA/ Roth IRA. Form 3106 allows you to separately direct where the interest portion and the after-tax portion of your deposits. (Note: there are several tax planning considerations involved in this decision. Seek advice if you’re not sure.)

What happens to your Federal Employee Health Benefit/ Federal Employee Dental and Vision Insurance Program (FEHB/ FEDVIP) if you have less than 5 years of service?

You will lose access to FEHB and FEDVIP 31 days after separation. You may elect Temporary Continuation of Coverage (TCC) which allows federal employees and their eligible family members to retain health insurance after separation (excluding cases of gross misconduct). TCC provides up to 18 months of coverage for separated employees. TCC can be expensive - 100% of the cost of your insurance plan plus a 2% admin charge.

TCC does not include dental or vision coverage.

What happens to your group life insurance (FEGLI) if you have less than 5 years of service?

Your FEGLI is discontinued but you have the option to convert some of all of your coverage to a private policy without a medical exam. Review the Notice of Conversion Privilege form for more information and to begin the process.

Deferred Retirement/ Separation with Deferred Pension

(>5 years of Service and under age 62)

Are you eligible for a pension if you leave with more than 5 years of service?

You qualify for a pension if you leave Federal service with at least 5 years of service. If you are less than age 62, you must wait until age 62 to request your pension.

Do you have to elect the deferred annuity?

No. You also have the option to request your FERS deposits at any time after leaving service. If you receive your FERS deposits, you are no longer eligible for a pension. The options to receive your FERS deposits are:

Receive a lump sum distribution. The deposits are after-tax except for any interest that has accrued. You will owe tax on the interest portion.

Roll the assets to an IRA/ Roth IRA. Form 3106 allows you to separately direct where the interest portion and the after-tax portion of your deposits. (Note: there are several tax planning considerations involved in this decision. Seek advice if you’re not sure.)

How is your pension calculated if you leave service under a deferred retirement?

If you leave your FERS deposits, you can request your annuity at age 62**. You will receive 1% of your high-3 for each year of service. For example, if you have 7 years of service and your high-3 is $100,000 your annuity will be 1% 7 $100,000 = $7,000 per year (or about $583/ month). Keep in mind that your high-3 will not receive any COLA increases. So if your high 3 is $100,000 today, in 20 years it will still be $100,000. If we assume inflation of about 2.5% per year $100,000 will “feel like” about $61,000.

**Note: There are a couple of situations where you can request your deferred annuity earlier:

If you have at least 20 years of service, you can request your unreduced annuity at age 60

If you have at least 30 years of service, you can request your unreduced annuity at MRA

Can you elect a survivor benefit on your pension if you leave service with a deferred retirement?

When you request your pension, you can elect a survivor benefit. If you pass away before your pension begins, your spouse will receive only your FERS deposits.

What happens to your Federal Employee Health Benefit/ Federal Employee Dental and Vision Insurance Program (FEHB/ FEDVIP) if you leave under deferred retirement?

You will lose access to FEHB and FEDVIP 31 days after separation. You may elect Temporary Continuation of Coverage (TCC) which allows federal employees and their eligible family members to retain health insurance after separation (excluding cases of gross misconduct). TCC provides up to 18 months of coverage for separated employees. TCC can be expensive - 100% of the cost of your insurance plan plus a 2% admin charge.

TCC does not include dental or vision coverage.

What happens to your group life insurance (FEGLI) if you leave under deferred retirement?

Your FEGLI is discontinued but you have the option to convert some of all of your coverage to a private policy without a medical exam. Review the Notice of Conversion Privilege form for more information and to begin the process.

Postponed Retirement (MRA+10)

If you reach your minimum retirement age and you have at least 10 years of service, you can separate under a postponed retirement. Postponed retirement is similar to a deferred retirement with three key differences:

1) you can elect to request your pension as early as full retirement age but will see a reduction of 5% per year before age 62,

2) you can elect a survivor benefit for your spouse and

3) you can reinstate FEHB and FEGLI when your pension begins (assuming you were enrolled in FEHB and FEGLI for at least 5 years prior to separation).

Let’s walk through it.

Are you eligible for a pension if you leave with a postponed retirement?

You qualify for a pension if you leave Federal service at MRA or older with at least 10 years of service. You may request your pension to begin immediately however you will see a reduction of 0.417% (5%/ year) for each month you are under age 62. For example, let’s say your full annuity (if you wait until age 62) is calculated to be $3,000 per month but you’re age 58 and would like to begin your annuity right now. Then your annuity would be $2,400 per month instead of $3,000. Furthermore, there are no COLA increases until you reach age 62.

Do you have to elect the annuity?

Yes. You can elect to defer your annuity until qualifying for regular FERS retirement (usually age 62), or you can elect an immediate, reduced annuity, but you cannot elect to have your FERS deposits paid in a lump sum.

How is your pension calculated if you leave service under a postponed retirement?

As long as you delay requesting your annuity until age 62, you will receive 1% of your high-3 for each year of service. For example, if you have 7 years of service and your high-3 is $100,000 your annuity will be 1% 7 $100,000 = $7,000 per year (or about $583/ month). Keep in mind that your high-3 will not receive any COLA increases. If you request your pension to begin before reaching age 62, your annuity calculation is the same as above but then you must decrease the annuity by 0.417% for each month before age 62.

Can you elect a survivor benefit on your pension if you leave service with a postponed retirement?

Yes, you can elect a 50% or 25% survivor benefit.

What happens to your Federal Employee Health Benefit/ Federal Employee Dental and Vision Insurance Program (FEHB/ FEDVIP) if you leave under postponed retirement?

You will lose access to FEHB and FEDVIP 31 days after separation unless you opt to receive a immediate, reduced annuity. You can reinstate FEHB and FEDVIP when you request your annuity as long as you carried FEHB for at least 5 years prior to separation.

If you lose access to FEHB, you may elect Temporary Continuation of Coverage (TCC) which allows federal employees and their eligible family members to retain health insurance after separation (excluding cases of gross misconduct). TCC provides up to 18 months of coverage for separated employees. TCC can be expensive - 100% of the cost of your insurance plan plus a 2% admin charge.

TCC does not include dental or vision coverage.

What happens to your group life insurance (FEGLI) if you leave under postponed retirement?

Your FEGLI is discontinued at separation but you have the option to reinstate FEGLI when you request your annuity as long as you carried FEGLI for at least 5 years prior to separation.

Immediate Retirement (MRA+30; Age 60 + 20 years; Age 62 + 5 years)

This is "regular" FERS retirement. If you are:

at least MRA and have at least 30 years of service (MRA+30) OR

at least 60 with at least 20 years of service (Age 60+20) OR

at least age 62 with at least 5 years of service (Age 62+5),

you are eligible for a full, unreduced immediate annuity. You are also eligible to maintain FEHB, FEDVIP, and FEGLI. You may also elect a 50% or 25% survivor benefit on your pension.

How is your pension calculated under an immediate retirement?

If you meet the criteria for immediate retirement but are under age 62 then you will receive 1% of your high-3 for each year of service.

If you meet the criteria for immediate retirement and have less than 20 years of service, then you will receive 1% of your high-3 for each year of service.

If you are at least age 62 and have at least 20 years of service, then you will receive 1.1% of your high-3 for each year of service.

You will not receive COLA on your pension until age 62. However, you maybe eligible for the Special Retirement Supplement from the time your pension begins until age 62.

Getting Help

The last couple of months have been filled with chaos and confusion. You may have thought you were years from leaving/ retiring from Federal service and had time to understand your benefits.

As the plans for a large-scale RIF unfold, be proactive. It's time to clearly understand what a Federal job change means for your family and your overall financial plan.

Email your questions or book a consult today.

Comments